Capital gains tax calculator for home sale

The IRS taxes unrecaptured Section 1250 gains at a rate of 25. How to Calculate Your Capital Gains Tax on a Home Sale.

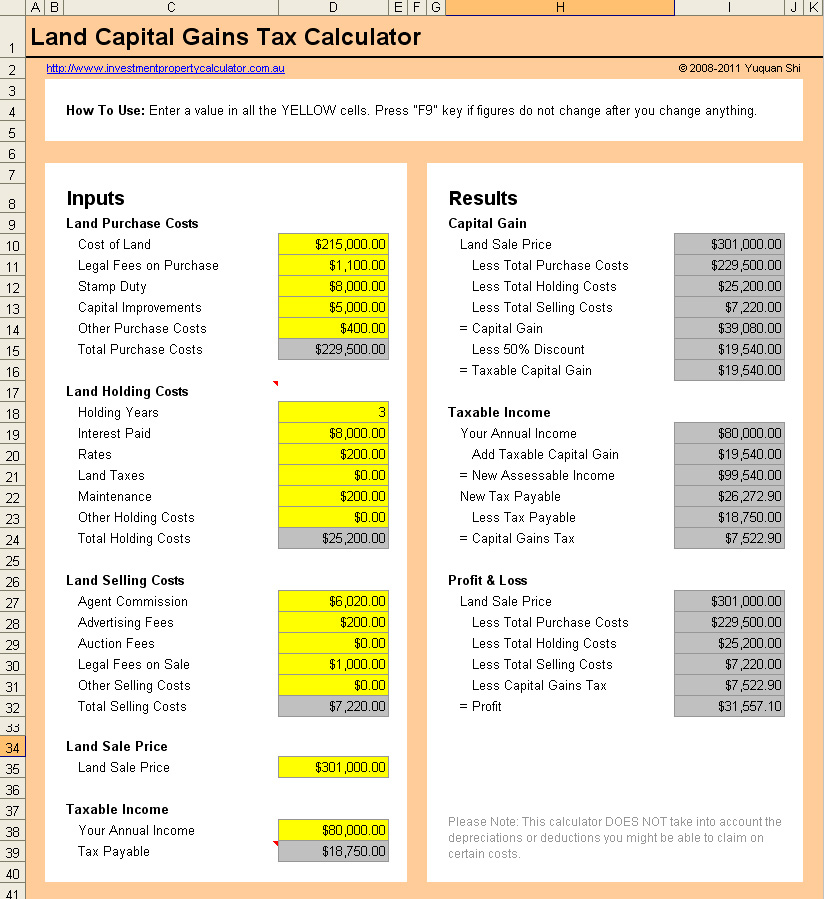

Free Investment Property Calculator Excel Spreadsheet Investment Property Spreadsheet Template Excel Spreadsheets

As a married person you can claim up to 500000 in capital gains deductions.

. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Calculate Capital Gains Tax on property If you have Capital Gains Tax to pay You must report and pay any Capital Gains Tax on most sales of UK property within 60 days. Total Capital Gains Tax.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Simply enter your total earnings. Heres a simple example.

2022 Capital Gains Tax Calculator. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. Use this tool to calculate applicable capital gain tax on your.

Reporting a loss The. You have indicated that you received a Form 1099-B Proceeds From Broker and Barter Exchange Transactions. Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK.

This handy calculator helps you avoid tedious number. You must account for and report this sale on your tax return. 998 Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset.

Looking ahead to the 2022 tax. Calculate the Capital Gains Tax due on the sale of your asset. Capital gains and losses are taxed differently from income like wages.

Calculate the Indexed Acquisition Cost. 250000 of capital gains on real estate if youre single. Capital gains calculation for a property depends on the tenure for which the property has been held.

Long Term capital gains from property is taxed at flat rate of 20 after taking indexation in account. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property. Additionally your income means you will be subject to a 15 percent capital gains tax rate.

Ad If youre selling stock real estate or a business youve got a 180 day window to act. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. This can be calculated by multiplying the purchase price of the house which is Rs 4500000 with the indexation factor of 152.

Capital gains on the sale of a property There are many misconceptions about capital gains tax in Canada. 500000 of capital gains on real estate if youre married and filing jointly. Ad If youre one of the millions of Americans who invested in stocks.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Use this tool to estimate capital gains taxes you may owe after selling an investment property. The inclusion rate for personal.

If sold within 2 years its SHORT Term Capital gains or loss. Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK. For this tool to work you first need to state.

5 the income range rises slightly to the 41675459750. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Visit The Official Edward Jones Site. Experienced in-house construction and development managers. If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021.

Experienced in-house construction and development managers. Ad If youre selling stock real estate or a business youve got a 180 day window to act. For example if you bought a home 10 years ago for 200000.

So the current rate is. Your capital gain is the sale amount minus your basis or what you paid. New Look At Your Financial Strategy.

However before we begin with the formulas to calculate capital gains. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds.

Pin On Financial Management

Property Tax Calculator Deals 56 Off Www Ingeniovirtual Com

How To Save Capital Gain Tax On Sale Of Residential Property

San Diego Capital Gains Tax On Rental Property In 2022 Mortgage Loans Rental Property San Diego Real Estate

What Is Capital Gains Tax Www Qredible Co Uk Bina Haber

Capital Gain Tax Calculator 2022 2021

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax What Is It When Do You Pay It

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

Capital Gains Tax Calculator 2022 Casaplorer

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Home Seller Net Proceeds Calculator Calculate Your Net Closing Costs On Real Estate Sales In 2022 Real Estate Sales Closing Costs 30 Year Mortgage

Profit Calculator For Home Sale On Sale 50 Off Www Ingeniovirtual Com

A 500 000 Gift From Uncle Sam Maybe Capital Gains You And San Francisco Real Estate With Kevin And Jonathan Vanguard Properties

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Cleartax 39 S Guide To Tax Implications On Capital Gains From Sale Of Shares House Property Filing Taxes Tax Refund Income Tax Return